Get ready to experience the easiest process

Discover how you can save time and money for your next home purchase or refinance.

35+ Years Changing Lives

100+ 5-star Customer Reviews

1,000+ 5-star Customer Reviews

200+ 5-star Customer Reviews

Explore our competitive interest rates

We offer competitive interest rates to all of our clients! We’re happy to show you what you qualify for and give you all of your options. We want to help you make the best decision for you and your family.

Explore our competitive interest rates

We offer competitive interest rates to all of our clients! We’re happy to show you what you qualify for and give you all of your options. We want to help you make the best decision for you and your family.

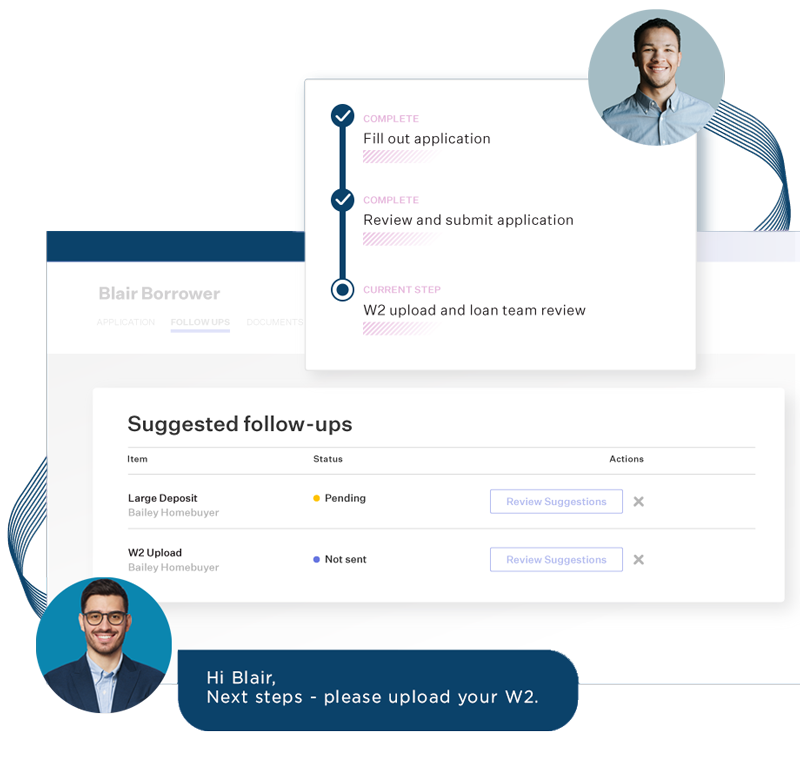

A stress free way to buy or refinance

You can get you pre-approved in minutes by applying online and meeting with our loan officers. We’ll gather all of your documents to give you a clear picture of what you qualify for.

We close your home fast and easy

The traditional process of buying or refinancing a home can be downright stressful and confusing. We are breaking the status quo by making the process easy and accessible so you can sit back and relax.

A stress free way to buy or refinance

You can get you pre-approved in minutes by applying online and meeting with our loan officers. We’ll gather all of your documents to give you a clear picture of what you qualify for.

Close on your home quickly

Our goal is to save you time and money on your next home purchase or refinance. We’ll work with you and your schedule to close on your home quickly!

We've been changing lives, one home at a time since 1984.

We do this by starting with your home goals and creating a plan of action!

Standing strong since 1984

We’ve grow a lot in the last few decades, but one thing has never changed. Our team cares about your needs and wants to make the home buying or refinancing experience enjoyable!

Rely on us for all your home buying needs.

We will take you through each step of the mortgage loan process and prepare you for what comes next. We’re going to keep you in the loop and updated every step of the way!

Worry -Free

We get you set up for success and keep you up to date throughout the process!

Affordable Pricing

Let's get you the best value and pricing on your next home loan!

In-House Operations

Our operations team gets your loan through the pipeline FAST so that we can close on-time!

Changing lives, one home at a time

We take pride in making the mortgage experience easy and stress-free.