Reverse Mortgage

Reverse Mortgage

NO MONTHLY MORTGAGE PAYMENTS

REVERSE MORTGAGES – IF YOU’RE OVER 62, LET THE BANK PAY YOU.

Sun American Mortgage does more reverse mortgages than any other company in the Southwest! Choose a local expert with the lowest cost.

A reverse mortgage or home equity conversion mortgage (HECM) is a type of home loan for older homeowners (62 years or older) that requires no monthly mortgage payments. This is an FHA insured loan. A reverse mortgage loan allows those who are at least 62 years of age, or older, to pay off a forward mortgage loan or use the equity in their home for other purposes. In general terms, a borrower needs at least 40 to 57% (depending on age) in equity to be able to purchase or refinance with a reverse mortgage loan.

The amount varies depending on the age of the borrowers. Those who qualify on a reverse mortgage refinance can receive a lump sum of cash, a monthly income, a line-of-credit, or a combination of those things. In a traditional mortgage loan, you pay the lender, but with a reverse mortgage the lender pays you!

You are not required to pay back the home loan until the home is sold or otherwise vacated. As long as you live in the home, you are not required to make any monthly mortgage payments toward the loan balance. You are required to remain current on your property taxes, homeowners insurance and condominium fees (if you live in a condo), as well as maintaining upkeep on the home.

The home owners retain title to the property with a Reverse Mortgage. No repayment is required as long as the borrower lives in the property. In the event of death, heirs are responsible to pay off the lower of the loan balance or upon received a current appraisal, they can pay 95% of the appraised value.

Contact one of our Reverse Mortgage Specialists to find out if a Reverse Mortgage is right for you!

*Must be 62 years or older to qualify. Borrower must have a minimum percentage of equity in the home to qualify. Other terms and conditions may apply.

WHY CHOOSE A REVERSE MORTGAGE?

- No Monthly Mortgage Payment Required

- Minimum 40-57% equity required to qualify (according to age)

- Financial assessment required

- No minimum credit score requirements

- Requires upfront and monthly mortgage insurance (MI)

- An advantage of a reverse mortgage refinance would be to possibly receive monthly income or a lump sum

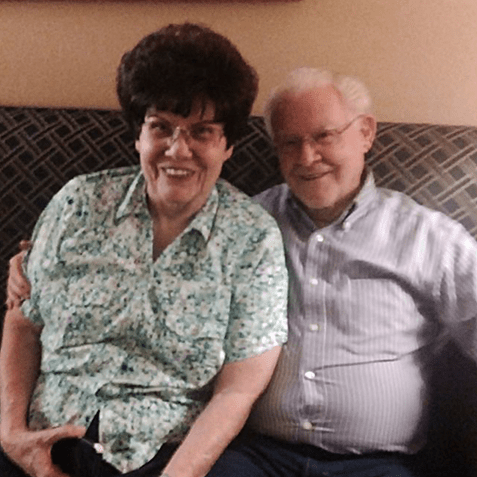

Why We Chose a Reverse Mortgage

When health issues arose and we could no longer stay in our home because my husband needed a one level home. Knowing this would be our final home, we chose to do a Reverse Mortgage.

We did it mainly for the purpose of not having a mortgage payment. It would free up a little money for things that might come up. Being older you never know what issues you will be facing.

Our realtor directed us to The Staples Group and mortgage loan consultant Nan Glauser. She was wonderful in helping us every step. One thing I appreciate about Nan was that she was always letting us know what was happening with each step that needed to be done. She would contact me at least weekly and most often many times a week or daily. I felt like she really cared and was concerned about us, especially with my husband’s health issues. It was a blessing having Nan Glauser as our consultant.

Thank you Nan for blessing us and getting us into our new dream home that we love and are enjoying so much.

-The Alldredge Family